MPS Tax Credit Calculator Information

MPS Tax Credit Information

You can access a tax calculator here to estimate the cost of the millage based on the taxable value of your home. Please note that if you have a limited household income or are a senior citizen with limited fixed income, you may be eligible for the Michigan Homestead Property Tax Credit. Please see the information below regarding the tax credits which may reduce your taxation amounts.

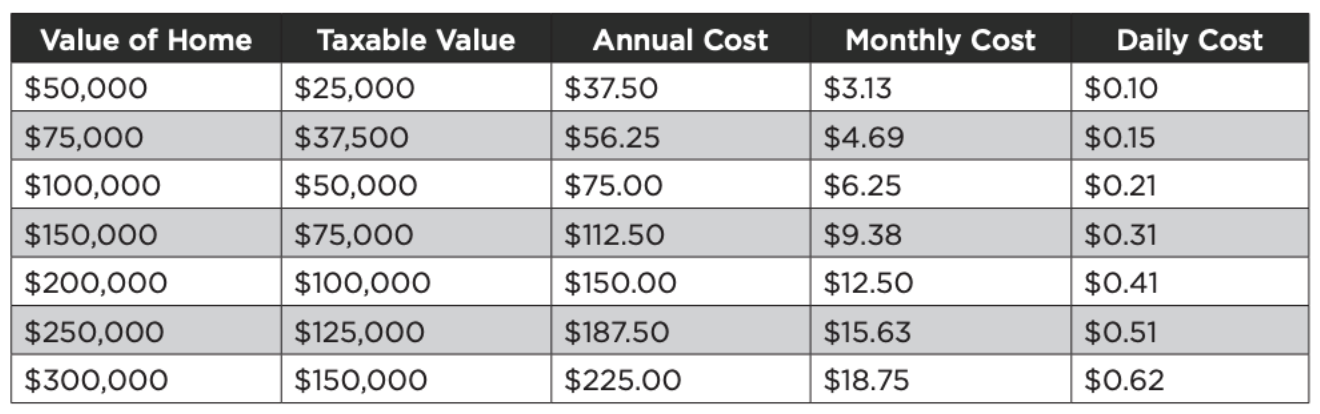

Some general taxation examples for this proposed millage are:

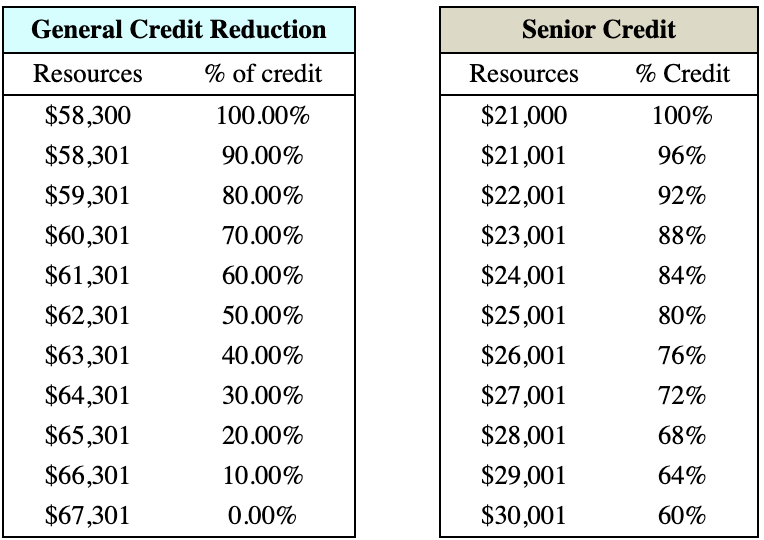

The 2023 Michigan Homestead Property Tax Credit enables some households that pay homestead property taxes greater than 3.2% of their annual income to be eligible for Michigan’s Homestead Property Tax Credit. Eligible households may deduct up to 60% (up to 100% for senior citizens, please see the senior credit table below) of the millage increase cost up to a $1,700 Homestead Tax Credit limit. The eligibility for the credit begins to decrease after household income exceeds $58,301 and ends completely after the household income exceeds $67,301. The increase in taxes as a result of this millage could potentially be offset by the Michigan Homestead Property Tax Credit. Please see the general reduction table and senior credit table below for a rough estimate and use the provided tax calculator for specific household estimates:

You can find more detailed information regarding all types of taxes and tax credits in the 2022 Michigan Taxpayer's Guide.